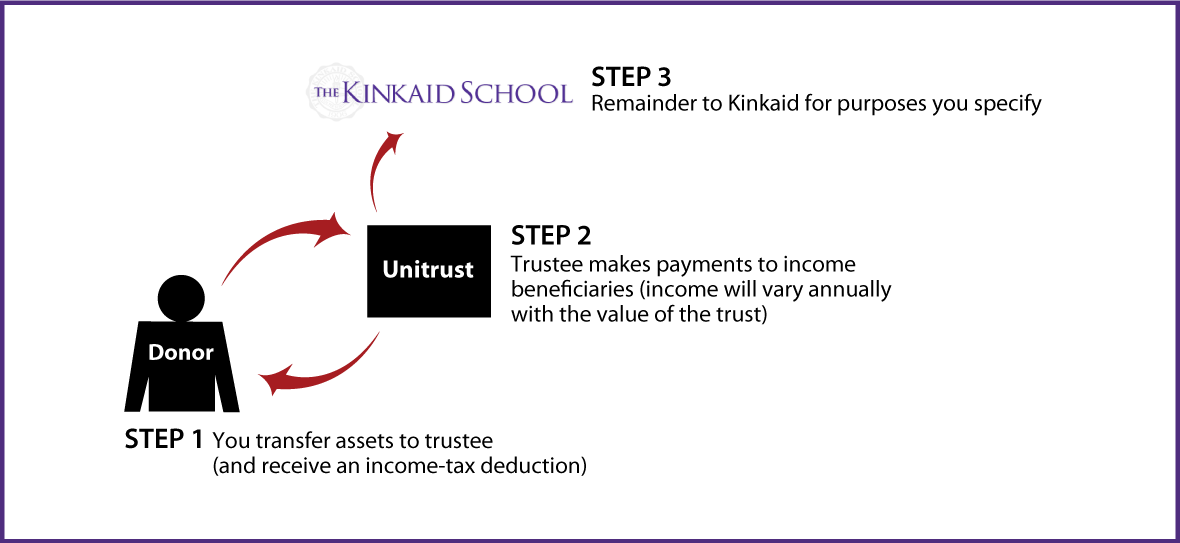

Charitable Remainder Unitrust

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to Kinkaid for purposes you specify

Benefits

- Payments to one or more beneficiaries, varying annually with the value of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust is established; property is sold by the trust

- Trust remainder will provide generous support for Kinkaid

Request an eBrochure

Request Calculation

Contact Us

Lisa Wood

Assistant Director of Advancement

(713) 243-5023

legacygiving@kinkaid.org

The Kinkaid School

201 Kinkaid School Drive

Houston, TX 77024

Federal Tax ID Number: 76-0295523

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer